If any transactions are suspicious reply DENY, and Wells Fargo will call you. The first indication something had gone wrong in my finances came via text message stating: “Please verify activity on Wells Fargo card ending in XXXX: $204.0 Transaction on 09/22/17 $204.0 Transaction on 09/26/17 If all transactions are valid reply CONFIRM. That’s not the kind of service I expect from my bank and it’s not the kind of service any bank should be able to provide.

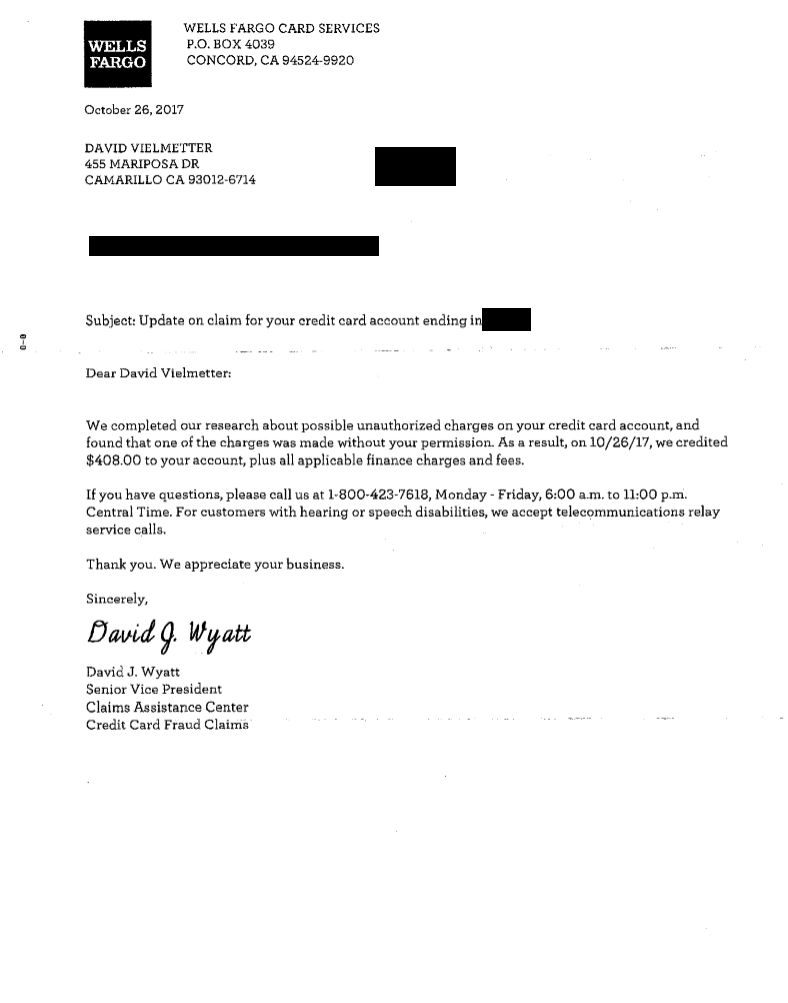

It’s equally possible that I would have simply had to pay $859.33 out of pocked to cover the fraud had I done nothing. I never spoke to the same person twice and was unable to reach any individual to whom I had previously spoken to about my case.įor those stuck in a similar situation: Yes, it’s possible that Wells Fargo would have eventually credited the fraudulent charges back to my account regardless of all my work and frustration. Throughout the entire process, I felt like I was working with a third party outsourced call center with zero accountability to Wells Fargo customers. I believe the reason Wells Fargo finally did credit the charges, is the direct result of me spending a huge amount of time and effort collecting evidence and documentation in an effort to prove that I was a victim of identity theft and that the charges were made without my authorization.įor a company that mentions the term “ Zero Liability” in reference to fraud charges more than 100 times on their website, I feel I was treated incredibly unfairly and pretty far from what I would expect from any customer service.

Wells fargo online dispute plus#

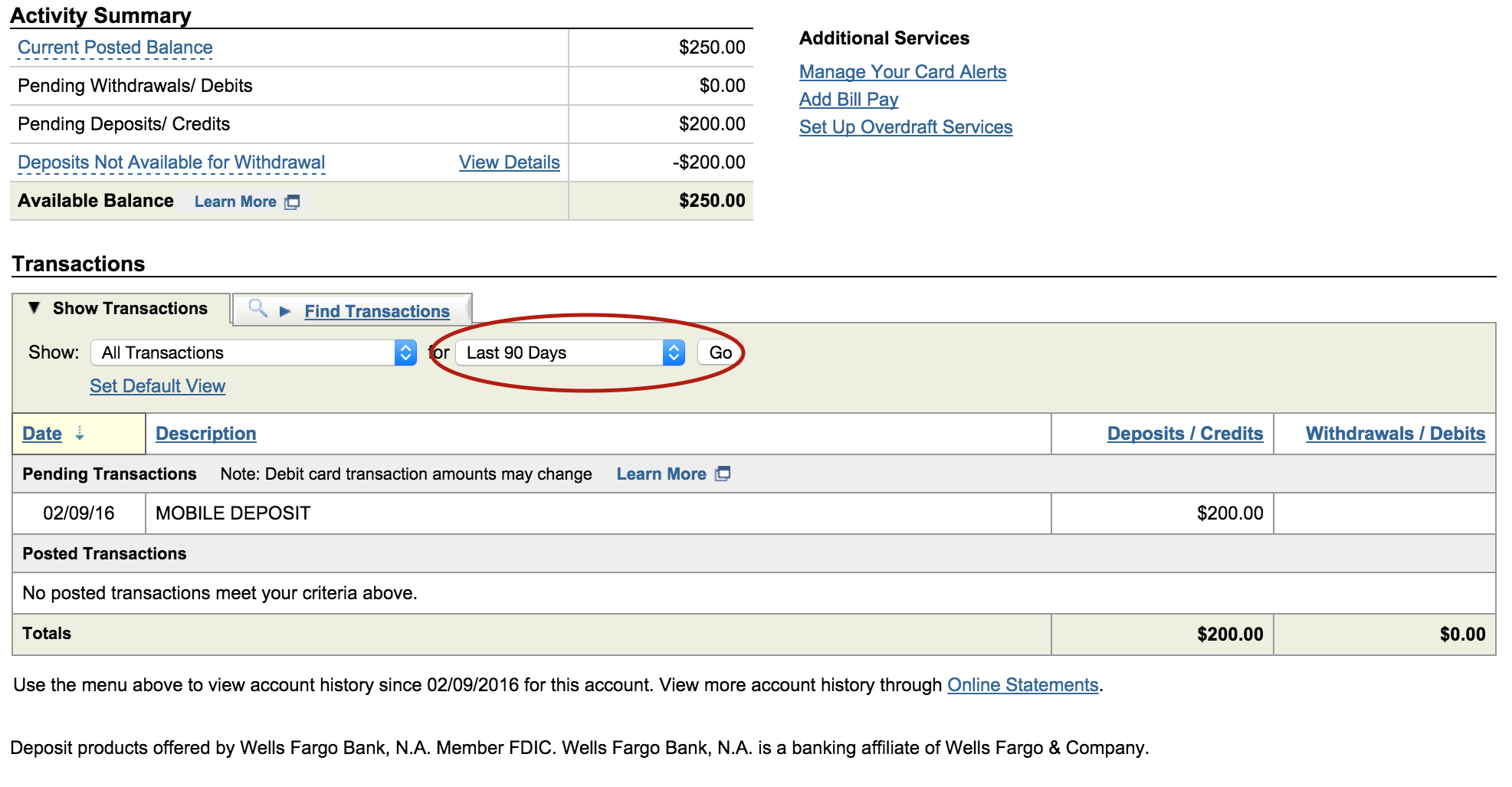

The log below represents a detailed account of the events that followed over the course of the next 54 days in September 2017 and eventually resulted in Wells Fargo crediting all fraudulent charges back to my account plus $9.22 which I have not returned and consider an a-hole tax. I immediately responded (via text reply) indicating that they were made without my authorization. Wells Fargo systems initially spotted some of the suspicious activity on my credit card account and sent me a text message asking about their legitimacy. Especially on accounts that have been flagged for previous fraud activity. NOTE: Wells Fargo has since made this more difficult.

Wells fargo online dispute code#

Using this information, anyone could set up a PIN code on anyone’s credit card if one hadn’t been set up. All you needed was a credit card number, the cardholders name, birthdate, and the last 4 of their social security number. How did this happen? Well, at the time, Wells Fargo allowed setting of new PIN codes on existing credit cards via automated phone system. This individual then managed to make several cash advance withdrawals using just my credit card number and the PIN. On Septemsomeone contacted Wells Fargo bank and managed to set a Personal Identification Number (PIN) on my Wells Fargo credit card using stolen identity information (likely leaked by the Target or Home Depot data breach). Here I’ve posted a complete account including records, conversations and communications between myself and Wells Fargo (with names and account numbers redacted) so it can serve as a public record of my personal experience dealing with the Wells Fargo Disputes Resolution Department and Wells Fargo Fraud Prevention Department as a victim of identity theft.

NOTE: This site serves as a psa about how disputing three relatively small fraudulent charges on my Wells Fargo issued credit card led to a 54 day ordeal that permanently and irrevocably broke my trust in Wells Fargo Bank. This event so soured my relationship with the company that some supposed “ re-establishing” mea culpa/ad campaign and the eventual vindication of my fraud claim will always end up being simply too little too late. In September 2017, however, an event occurred that can only be described as a conscious uncoupling between Wells Fargo and myself. I was a Wells Fargo customer for 23 years prior to this incident and my overall experience with them as a banking institution had been relatively positive.

0 kommentar(er)

0 kommentar(er)